Miercoles 09/08/11 Comercio Internacional Mayorista

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

Veo varios artículos echandole porras a BAC e indicando que hay que levantar con pala, cómo lo ves admin? o solo es un engañamuchachos? considerando que se le viene una demanda por US$10K millones

- Victor VE

- Mensajes: 2987

- Registrado: Jue Abr 22, 2010 8:33 am

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

Con toda la incertidumbre en la economia no la compraria hasta que las cosas mejoren, prefiero a Goldman Sachs en el sector.

- admin

- Site Admin

- Mensajes: 165556

- Registrado: Mié Abr 21, 2010 9:02 pm

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

Victor VE escribió:Veo varios artículos echandole porras a BAC e indicando que hay que levantar con pala, cómo lo ves admin? o solo es un engañamuchachos? considerando que se le viene una demanda por US$10K millones

Revisa este video publicado hoy sobre el outlook de financieras

http://www.bloomberg.com/video/73737066/

- Ed_Alex

- Mensajes: 257

- Registrado: Mar Ago 02, 2011 3:13 pm

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

Platinum Cheaper Than Gold: A Rare Opportunity

Muy interesante artículo

http://seekingalpha.com/article/286055- ... pportunity

Muy interesante artículo

http://seekingalpha.com/article/286055- ... pportunity

- Victor VE

- Mensajes: 2987

- Registrado: Jue Abr 22, 2010 8:33 am

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

Asia Rebounds After Losses

By SHRI NAVARATNAM

SINGAPORE--Asian shares rebounded Wednesday drawing comfort from the U.S., where the Federal Reserve's pledge to keep interest rates low for two more years pushed stocks sharply higher.

"Market sentiment hasn't stabilized yet, so while we'll likely see a relief rally today, it'll be a rocky path to recovery," said Toshiyuki Kanayama, market analyst at Monex in Tokyo.

The dollar was mixed against its rivals, while the safe-haven Japanese yen held up solidly, underscoring the still-fragile market sentiment.

Regional stock markets saw one of the biggest selloffs since the 2008 financial crisis Tuesday.

Early Wednesday, Japan's Nikkei Stock Average rose 1.8% after three straight days of losses, Australia's S&P/ASX 200 gained 2.8%, South Korea's Kospi Composite advanced 2.3% and New Zealand's NZX-50 added 3.2%.

Dow Jones Industrial Average futures were 19 points higher on screen trade, after rebounding strongly in Tuesday's session. Fed officials on Tuesday committed to keep interest rates at their current exceptionally low levels "at least through mid-2013," suggesting policy makers will continue to support efforts to lift the struggling U.S. economy.

The yen, however, was steady after its sharp rise in recent sessions, and kept markets on alert for intervention by Japanese authorities.

The dollar was at ¥77.04, from ¥76.96 late in New York Tuesday, and at CHF0.7239 against the Swiss franc, from CHF0.7205. The Australian dollar pushed higher to US$1.0331 in line with the better sentiment, from US$1.0174 prior to the Fed statement.

It would be tempting to view Tuesday's gains as signaling that "some poise might be returning to global financial markets. But few will be willing to make this leap quite yet," Credit Agricole said in a note to clients.

The euro struggled as fears that the euro-zone debt crisis would spread to Spain and Italy kept investors on edge.

The single currency was at $1.4343, compared with $1.4373 in New York, and ¥110.52 against the yen, from ¥110.55.

Oil prices rose from Tuesday's multimonth lows, with the September Nymex crude futures up $2.06 at $81.36 a barrel. Gold prices took a breather after tapping fresh record highs in offshore trade; spot gold was at $1,741.90, down $2.20 from New York trade.

Stocks that took a heavy beating in recent sessions attracted buyers, although demand was measured across many markets. In Tokyo, Canon rose 1.1% and Inpex added 2.0%. However, concerns about the stubbornly strong yen weighed on some of the exporters, with Sony off 1.1%.

In Sydney, BHP Billiton advanced 3.1% and Woodside Petroleum rose 3.0%, while Hynix Semiconductor jumped 4.2% and Samsung Electronics added 0.6% in Seoul.

September Japanese government bond futures rose 0.21 to 142.34 points, led by gains in U.S. Treasurys Tuesday.

By SHRI NAVARATNAM

SINGAPORE--Asian shares rebounded Wednesday drawing comfort from the U.S., where the Federal Reserve's pledge to keep interest rates low for two more years pushed stocks sharply higher.

"Market sentiment hasn't stabilized yet, so while we'll likely see a relief rally today, it'll be a rocky path to recovery," said Toshiyuki Kanayama, market analyst at Monex in Tokyo.

The dollar was mixed against its rivals, while the safe-haven Japanese yen held up solidly, underscoring the still-fragile market sentiment.

Regional stock markets saw one of the biggest selloffs since the 2008 financial crisis Tuesday.

Early Wednesday, Japan's Nikkei Stock Average rose 1.8% after three straight days of losses, Australia's S&P/ASX 200 gained 2.8%, South Korea's Kospi Composite advanced 2.3% and New Zealand's NZX-50 added 3.2%.

Dow Jones Industrial Average futures were 19 points higher on screen trade, after rebounding strongly in Tuesday's session. Fed officials on Tuesday committed to keep interest rates at their current exceptionally low levels "at least through mid-2013," suggesting policy makers will continue to support efforts to lift the struggling U.S. economy.

The yen, however, was steady after its sharp rise in recent sessions, and kept markets on alert for intervention by Japanese authorities.

The dollar was at ¥77.04, from ¥76.96 late in New York Tuesday, and at CHF0.7239 against the Swiss franc, from CHF0.7205. The Australian dollar pushed higher to US$1.0331 in line with the better sentiment, from US$1.0174 prior to the Fed statement.

It would be tempting to view Tuesday's gains as signaling that "some poise might be returning to global financial markets. But few will be willing to make this leap quite yet," Credit Agricole said in a note to clients.

The euro struggled as fears that the euro-zone debt crisis would spread to Spain and Italy kept investors on edge.

The single currency was at $1.4343, compared with $1.4373 in New York, and ¥110.52 against the yen, from ¥110.55.

Oil prices rose from Tuesday's multimonth lows, with the September Nymex crude futures up $2.06 at $81.36 a barrel. Gold prices took a breather after tapping fresh record highs in offshore trade; spot gold was at $1,741.90, down $2.20 from New York trade.

Stocks that took a heavy beating in recent sessions attracted buyers, although demand was measured across many markets. In Tokyo, Canon rose 1.1% and Inpex added 2.0%. However, concerns about the stubbornly strong yen weighed on some of the exporters, with Sony off 1.1%.

In Sydney, BHP Billiton advanced 3.1% and Woodside Petroleum rose 3.0%, while Hynix Semiconductor jumped 4.2% and Samsung Electronics added 0.6% in Seoul.

September Japanese government bond futures rose 0.21 to 142.34 points, led by gains in U.S. Treasurys Tuesday.

- Arnold

- Mensajes: 1251

- Registrado: Jue Abr 22, 2010 8:45 am

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

admin escribió:Los inventarios de petroleo y el comercio mayorista, ninguno de los dos son super importantes, todo va a ser el efecto del Fed y lo que pueda pasar en Europa.

gracias

- javier34

- Mensajes: 88

- Registrado: Jue May 27, 2010 11:31 pm

- Ubicación: lima

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

Francia podria ser la proxima victina del downgrade

LONDON (MarketWatch) — The U.S. is broke? Been there. Italy is bankrupt. Done that. Spain is teetering on the edge? Got the T-shirt. There is, however, one major industrial country that has so far managed to sail through the market turmoil without anyone seriously questioning its credit-worthiness: France.

And yet, if you‘re looking for the next downgrade, and the source of the next shock to the global markets, it’s France you should be looking toward. The country’s debt is exploding. It is steadily losing competitiveness against Germany, and running up huge trade deficits. Its political system is every bit as dysfunctional as America’s. And, of course, it is about to be presented with a massive bill for bailing out Italy and Spain.

A French downgrade may only be a matter of time. If it happens, it’s going to be a huge blow to already-fragile markets. The country has the fourth largest debt in the world, and its paper is heavily traded by global investors. There would be some nasty losses on a French downgrade.

LONDON (MarketWatch) — The U.S. is broke? Been there. Italy is bankrupt. Done that. Spain is teetering on the edge? Got the T-shirt. There is, however, one major industrial country that has so far managed to sail through the market turmoil without anyone seriously questioning its credit-worthiness: France.

And yet, if you‘re looking for the next downgrade, and the source of the next shock to the global markets, it’s France you should be looking toward. The country’s debt is exploding. It is steadily losing competitiveness against Germany, and running up huge trade deficits. Its political system is every bit as dysfunctional as America’s. And, of course, it is about to be presented with a massive bill for bailing out Italy and Spain.

A French downgrade may only be a matter of time. If it happens, it’s going to be a huge blow to already-fragile markets. The country has the fourth largest debt in the world, and its paper is heavily traded by global investors. There would be some nasty losses on a French downgrade.

- Ed_Alex

- Mensajes: 257

- Registrado: Mar Ago 02, 2011 3:13 pm

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

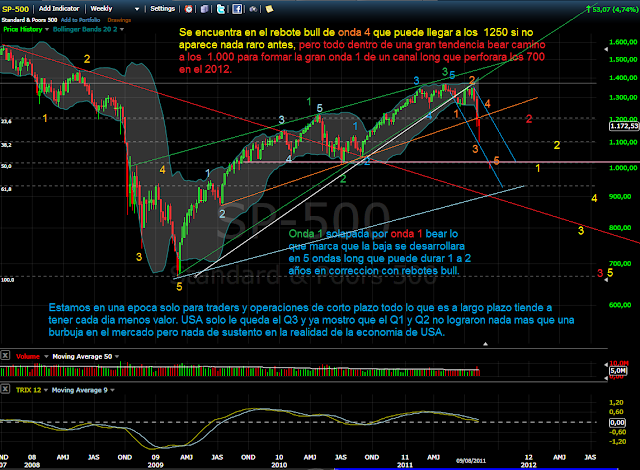

SP500 en tendencia bear con corrección bull camino a 1250!

Una corrección bull que dara alivio a muchos inversores pero no es para estar felices sino para apobechar esta etapa para salir antes que venga la gran caída que recién vimos una muestra del poder de pánico que ataca a los inversores cuando se rompen soportes por lo cual no entrar en codicia y solo proteger capital o hacer operaciones hiper cortas. Porque los bots bursátiles cuando arrancan a vender no piensan que el dinero es de humanos..

Una corrección bull que dara alivio a muchos inversores pero no es para estar felices sino para apobechar esta etapa para salir antes que venga la gran caída que recién vimos una muestra del poder de pánico que ataca a los inversores cuando se rompen soportes por lo cual no entrar en codicia y solo proteger capital o hacer operaciones hiper cortas. Porque los bots bursátiles cuando arrancan a vender no piensan que el dinero es de humanos..

- eduforever

- Mensajes: 595

- Registrado: Jue Abr 22, 2010 9:50 pm

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

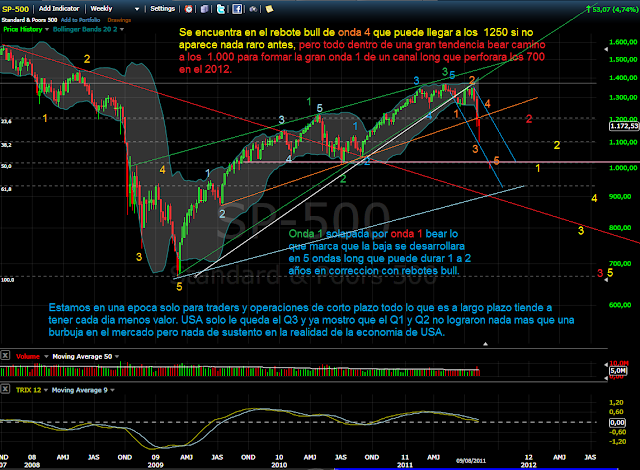

Soportes posibles del Dow Jones

Zona fibonacci desde la sub onda 1celeste llegaría a los 10750, pero se caería hasta los 10100 por onda 5 mayor dando inicio de una gigante onda 1 de una gran corrección que llegaría a medias a 6000 y terminaría por debajo de los 4000 a 3500 puntos si logran hacer algo que estabilice pero esto que viviremos sera peor a lo del 2008.

Zona fibonacci desde la sub onda 1celeste llegaría a los 10750, pero se caería hasta los 10100 por onda 5 mayor dando inicio de una gigante onda 1 de una gran corrección que llegaría a medias a 6000 y terminaría por debajo de los 4000 a 3500 puntos si logran hacer algo que estabilice pero esto que viviremos sera peor a lo del 2008.

- eduforever

- Mensajes: 595

- Registrado: Jue Abr 22, 2010 9:50 pm

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

Me estas bajando la moral, un par de levantadas mas del DJ y vendo todo (si es que acaso llega a seguir levantando). Lo espero en 7000, tanto rollo. Espera, dijiste 3500 puntos? creo que me dedicaré a las inversiones inmobiliarias, lo veo mas seguro, creo.

- Victor VE

- Mensajes: 2987

- Registrado: Jue Abr 22, 2010 8:33 am

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

Admin, hay alguna opción en el foro (implementado o por implementar) para marcar, digamos, como favoritos ciertos posts? de tal forma que pueda ubicarlos rápidamente? algo como un catálogo de los mismos.

Caso como el post de eduforever, me parece muy interesante pero en una semana me voy a olvidar en que dia se publicó y tendré que buscar dia por dia, post por post ya que el buscador en sí no es muy practico.

Caso como el post de eduforever, me parece muy interesante pero en una semana me voy a olvidar en que dia se publicó y tendré que buscar dia por dia, post por post ya que el buscador en sí no es muy practico.

- Victor VE

- Mensajes: 2987

- Registrado: Jue Abr 22, 2010 8:33 am

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

Victor VE escribió:Me estas bajando la moral, un par de levantadas mas del DJ y vendo todo (si es que acaso llega a seguir levantando). Lo espero en 7000, tanto rollo. Espera, dijiste 3500 puntos? creo que me dedicaré a las inversiones inmobiliarias, lo veo mas seguro que hay, creo.

Estimados yo ahora solo ORO con GLD y por alli una aurifera mas (ojo que JP le da 2500 para fin de año)......... y Plata con el SLV , ambos deberían llegar al 80% de mi portafolio. Es lo único en que no pierdes plata ahora. El resto en cash y por allí a hacer timbas en contra apenas lleguemos a los 11,600 puntos

- Ed_Alex

- Mensajes: 257

- Registrado: Mar Ago 02, 2011 3:13 pm

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

Treasurys Price Chg Yield %

2-Year Note 1/32 0.177

10-Year Note 4/32 2.225

* at close

7:28 a.m. EDT 08/10/11Futures Last Change Settle

Crude Oil 82.27 2.97 79.30

Gold 1764.1 21.1 1743.0

E-mini Dow 11093 -101 11194

E-mini S&P 500 1161.00 -10.75 1171.75

7:37 a.m. EDT 08/10/11Currencies Last (bid) Prior Day †

Japanese Yen (USD/JPY) 76.55 76.96

Euro (EUR/USD) 1.4354 1.4376

† Late Tuesday in New York.

2-Year Note 1/32 0.177

10-Year Note 4/32 2.225

* at close

7:28 a.m. EDT 08/10/11Futures Last Change Settle

Crude Oil 82.27 2.97 79.30

Gold 1764.1 21.1 1743.0

E-mini Dow 11093 -101 11194

E-mini S&P 500 1161.00 -10.75 1171.75

7:37 a.m. EDT 08/10/11Currencies Last (bid) Prior Day †

Japanese Yen (USD/JPY) 76.55 76.96

Euro (EUR/USD) 1.4354 1.4376

† Late Tuesday in New York.

- admin

- Site Admin

- Mensajes: 165556

- Registrado: Mié Abr 21, 2010 9:02 pm

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

Los futures del Dow Jones 86 puntos a la baja.

Au up 1,765

Oil up 82.46

El asia cerro en azul, Europa al alza.

Future cu up 4.01

-91

Yields down 2.23%

Au up 1,765

Oil up 82.46

El asia cerro en azul, Europa al alza.

Future cu up 4.01

-91

Yields down 2.23%

- admin

- Site Admin

- Mensajes: 165556

- Registrado: Mié Abr 21, 2010 9:02 pm

Re: Miercoles 09/08/11 Comercio Internacional Mayorista

El yuan sube.

- admin

- Site Admin

- Mensajes: 165556

- Registrado: Mié Abr 21, 2010 9:02 pm

¿Quién está conectado?

Usuarios navegando por este Foro: admin y 25 invitados